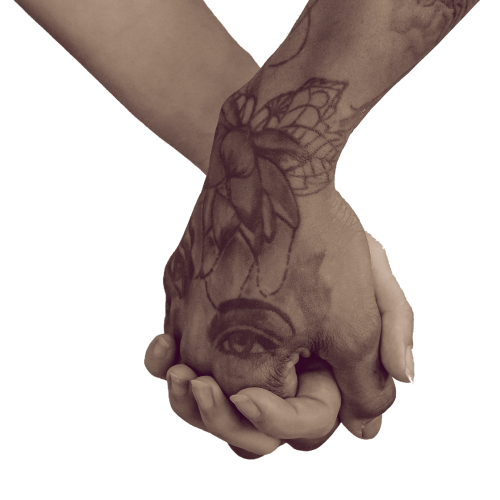

Co-creating a just and equitable society

Together, we’re moving toward gender justice

West Coast LEAF works to deepen justice and substantive equality for women, people who experience gender discrimination, and Indigenous peoples and communities. Through our community-engaged legal practice, we collaborate with those most impacted and marginalized by systems of oppression, and stop at nothing less than transformative social change.

What we do

We use legally rooted strategies to dismantle gender-based discrimination and move toward gender justice by advancing access to justice, healthcare, and economic security, promoting freedom from gender-based violence, and supporting child and family well-being.

Take action for justice and equity!

Who we are

We’re a passionate group of equity advocates striving toward positive systemic change in BC (and beyond) through litigation, law reform, and public legal education designed to create a more equitable, accessible, and just system for all.